10 Strategies to Minimize Your Exposure to Cyber Fraud

In celebration of this year's International Fraud Awareness Week, we are eager to provide practical strategies your organization can adopt to minimize the threat of cyber fraud. Digital fraud has the potential to destabilize your business in an instant, leading to minor crises, communication breakdowns, and market loss.

This International Fraud Awareness Week, we're eager to share practical strategies to help your organization combat cyber fraud. Digital fraud can swiftly dismantle your business operations, leading to significant financial losses and, most critically, eroding trust among your stakeholders. Moving swiftly in business doesn't always translate to efficient fraud prevention. A thoughtful, systematic approach to fraud prevention not only secures revenue but also enhances customer experiences and employee engagement, contributing to a more robust business.

View fraud prevention as a strategic opportunity to drive better business outcomes. Here are 10 expert tips for minimizing the risk of cyber fraud in your business:

-

Combat Phishing: Phishing, a primary source of corporate fraud, involves deceptive messages from fraudsters impersonating legitimate sources. Strengthen email security with tools that detect emerging threats, preemptively block attacks, and offer detailed insights into phishing trends impacting your organization.

-

Strengthen Password Policies: Frequent password changes, complex combinations, and unique credentials for each user are essential. Regularly update login details, especially after employee turnover, and secure your wireless network with strong, unique passwords.

-

Monitor Transactions Vigilantly: Daily review of bank accounts helps identify and address irregularities or unauthorized transactions. Verify executive account requests via phone or in-person rather than solely through email.

-

Leverage Machine Learning (ML): For organizations frequently targeted by fraud, ML can process vast data sets, recognize patterns, and recommend effective risk management strategies, continuously refining its efficacy over time.

-

Conduct Regular Fraud Audits: Regularly assess the effectiveness of your fraud-prevention tools and protocols, involving both internal and external experts, to ensure they adequately protect against fraud.

-

Executive Security Training: Given that top executives are often targets of sophisticated fraud schemes, ensure they receive specialized cybersecurity training. Awareness of BEC scams, deepfakes, spear phishing, and whaling is crucial for them to model security consciousness organization-wide.

-

Implement Data Encryption: Protect sensitive data during transmission and storage. Encryption adds a layer of security, rendering intercepted data unreadable to unauthorized parties.

-

Consult with Security Experts: Engage with cybersecurity experts and consultants for informed decision-making, identification of security gaps, and development of robust resilience strategies.

-

Form a Cybersecurity Oversight Committee: Comprising key executives and experts, this committee should guide strategic cybersecurity directions, oversee initiatives, and ensure proactive threat management.

-

Invest in Appropriate Technology: For remote and hybrid work models, address connectivity and security challenges through solutions like SASE, SSE, and automation.

Concluding Thoughts

While some recommendations may seem fundamental, basic controls can effectively prevent cyber attacks. The goal is to master these basics and then enhance your cybersecurity and fraud prevention strategies with more advanced techniques.

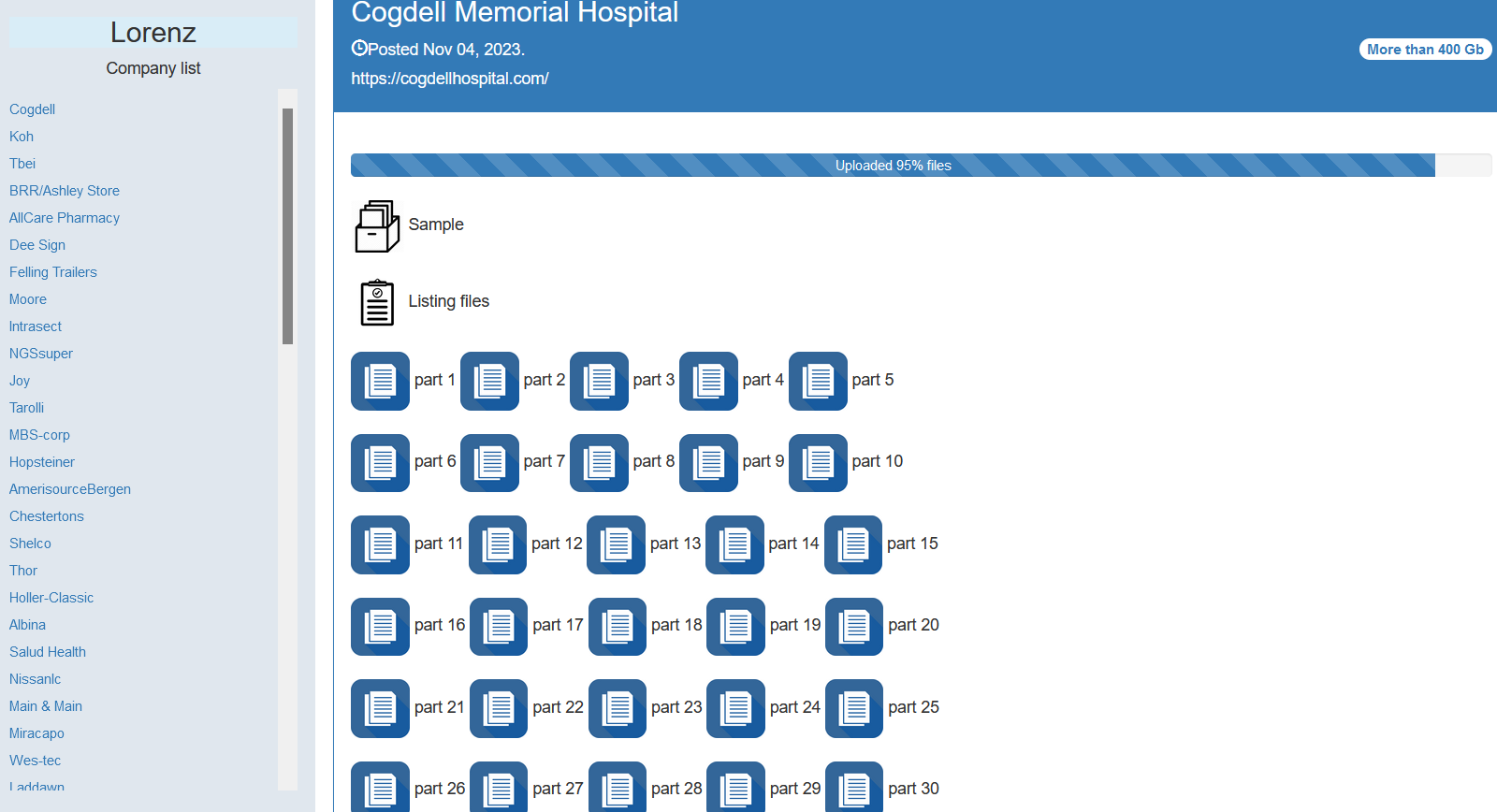

![Largest Data Breaches in US History [Updated for 2023]](https://nulld3v.com/uploads/images/202311/image_430x256_654e69df8d469.jpg)