EduFi, a startup from Singapore, secures funding for its student loan platform.

EduFi, a fintech startup based in Singapore, recently raised $6.1 million in a pre-seed funding round. The firm, which provides financially challenged students with the opportunity to secure loans for their education, saw investments led by Zayn VC. Other contributors included Palm Drive Capital, Deem Ventures, Q Business and various angel investors. EduFi has also introduced an artificial intelligence-powered lending platform that allows students to 'study now, pay later' (SNPL).

EduFi, an innovative fintech startup focused on empowering students through financial access, has successfully secured $6.1 million in pre-seed funding. The investment round was spearheaded by Zayn VC and saw contributions from Palm Drive Capital, Deem Ventures, Q Business, and several angel investors.

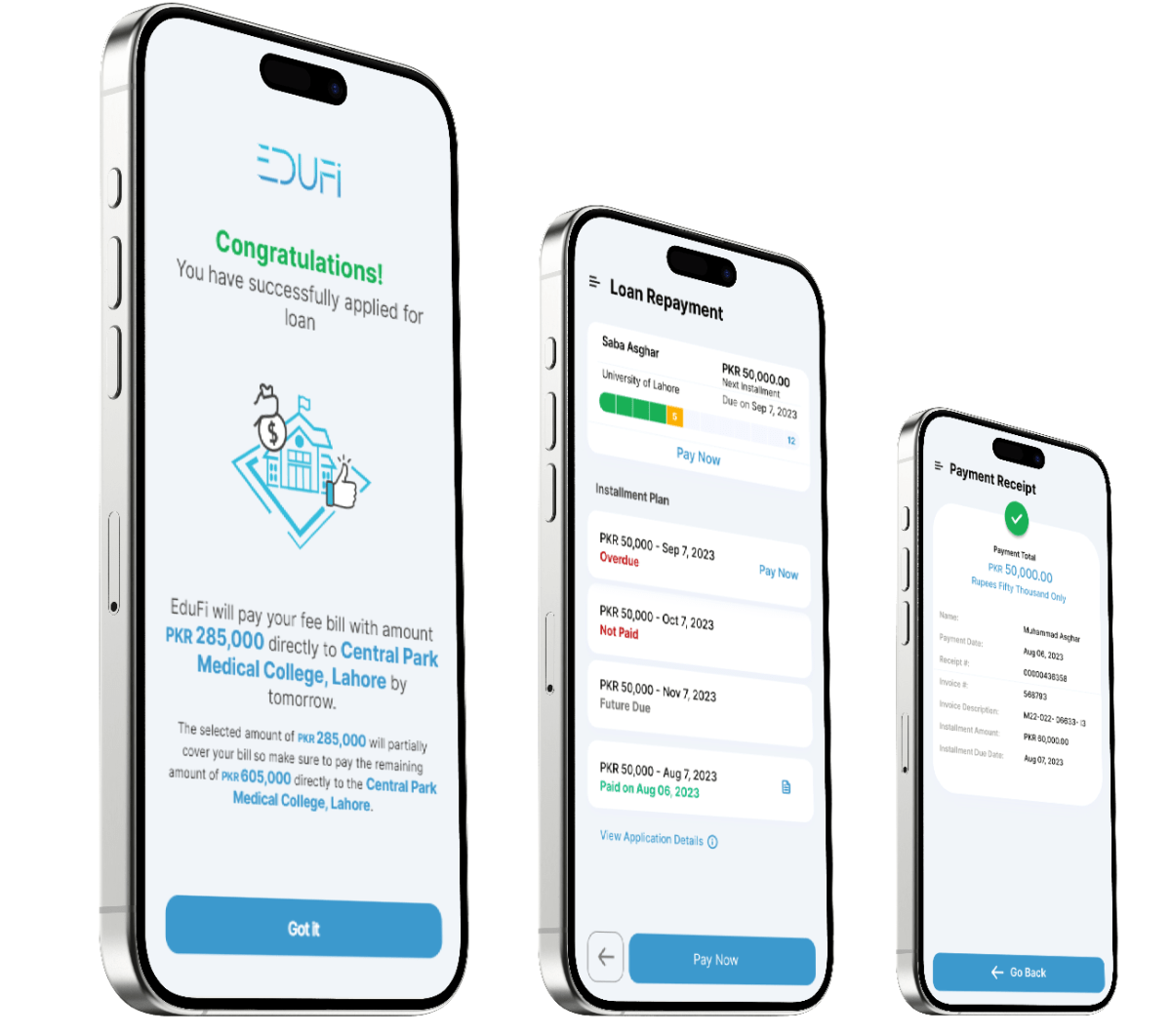

Headquartered in Singapore, EduFi is pioneering the introduction of an AI-driven 'Study Now, Pay Later' (SNPL) lending model with its mobile application, targeting the underserved student loan market in Pakistan. EduFi's CEO, Aleena Nadeem, an MIT alumna with a background in Goldman Sachs and Ventura Capital, envisions the platform as a solution to Pakistan's high poverty and low literacy rates. The platform aims to bridge the financial gap for Pakistani students who face obstacles in affording private education due to the inadequate quality of public schools.

EduFi has already forged partnerships with 15 universities, making the app accessible to approximately 200,000 students across various degree programs. The application process through the app requires applicants to demonstrate a stable financial background, with loan disbursements made directly to the educational institutions.

During an 18-month beta phase, EduFi refined its credit model against a backdrop of consumer finance loans from banks, boasting a rapid loan approval process of just 48 hours. The startup is in the final stages of obtaining a lending license from the Securities and Exchange Commission Pakistan (SECP), with expectations to finalize in November.

EduFi's model disrupts traditional banking processes by offering lower interest rates, a streamlined application procedure, and more flexible terms, significantly reducing the approval time compared to conventional methods.

The fresh influx of capital will fuel EduFi's mission to broaden its customer base, enhance the platform's user experience, explore expansion opportunities in neighboring regions, and introduce additional fintech products like student credit cards.

Faisal Aftab of Zayn VC lauded EduFi's commitment to financial inclusion for families challenged by education costs, especially amidst rising inflation. EduFi stands as a beacon of hope, transforming education financing and enabling families to invest confidently in their children's futures.

![Largest Data Breaches in US History [Updated for 2023]](https://nulld3v.com/uploads/images/202311/image_430x256_654e69df8d469.jpg)